Written By: Chad Kellar

and Matthew Schell

The FASB Issued the final CECL standard on June 16, 2016. For up-to-date information and resources, visit the CECL page or access the updated CECL Prep Kit.

The final deliberations by the Financial Accounting Standards Board (FASB) on its project related to the impairment of financial instruments are drawing to a close, and the board is expected to issue a final standard in the first half of 2016. Of course, prior to deciding to issue a final standard, the board, as a matter of due process, will ask themselves whether re-exposure is warranted. While the deliberations are not yet complete and the wording from the proposal will be tweaked, the CECL model, which was proposed in December 2012, removes the “probable” threshold that exists today and requires the development of an estimate of all contractual cash flows not expected to be collected. Given the pervasive impact, many financial institutions are beginning to think about the impact the new model is likely to have on their allowance methodologies.

The new standard is expected to be flexible enough to allow financial institutions to use different methodologies to determine their allowance. There is some discussion of the possibility that implementation of CECL could be achieved by incorporating existing risk management practices into the allowance methodology, which avoids the need to reinvent the wheel. Step one is for management to evaluate the current data and methodologies to determine what new information will need to be acquired and what changes will have to be instituted to transition to the CECL model.

To understand what changes a financial institution might need to make, it is important to consider a few factors:

- What instruments will be included in the scope of the new CECL model?

- How will expected credit losses be evaluated? What methodologies will be allowed?

- What changes to the current methodology and available data will be necessary?

Evaluate the Scope

The FASB concluded during its re-deliberations that entities will apply the CECL model to financial assets measured at amortized cost. Financial assets measured at amortized cost for a typical financial institution include more than just loans; they will include other financial assets such as debt securities that are classified as held to maturity (HTM). In addition, the FASB concluded that both funded and certain unfunded loan commitments would apply the CECL model.

Debt securities that are classified as available for sale (AFS) will be excluded from the CECL model. The accounting for impairment of AFS debt securities will follow a new modified impairment process that is a combination of the current other-than-temporary impairment (OTTI) approach in FASB Accounting Standards Codification (ASC) 320 and the new CECL model. The new modified impairment approach will no longer require an entity to consider the length of time that the fair value of the security has been below amortized cost; this requirement has been part of the current OTTI analysis. In addition, entities will record an allowance for expected credit losses, rather than a direct write-down, on AFS debt securities that can be reversed immediately in the period of recovery in expected cash flows. However, an allowance for an AFS security would not be recorded “if the financial asset’s fair value equals or exceeds its amortized cost basis.”

Equity securities, also excluded from the scope of the CECL model, will be accounted for either at fair value with changes recognized in net income or under other appropriate accounting (the equity method or the practical expedient for equities without a readily determinable fair value, for example).

Crowe Observations:

- Including HTM debt securities in the CECL model will result in a change in practice. Previously these securities had been evaluated using the OTTI model.

- The change for all HTM or AFS debt securities to use an allowance, rather than recording a direct write-down (basis adjustment), is positive. By using an allowance, improvement in credit may be recognized immediately.

- Purchased credit-impaired (PCI) financial assets and certain beneficial interests in securitized financial assets, if measured at amortized cost, will record an allowance for expected credit losses under the CECL model upon acquisition (which is a change from current practice) and in subsequent periods. (Note that the FASB plans to simplify the current PCI model by recording the face (par) amount, allowance, and noncredit discount such that current loan subledgers may be used. )

- Some types of securities that are PCI or beneficial interests in securitized financial assets that would have historically qualified to be accounted for as AFS will not be accounted for under the CECL model because they are not measured at amortized cost. At this juncture, the board has no published tentative decisions on how to handle these types of instruments.

Develop an Estimate of Expected Credit Losses for the CECL Model

When determining how expected credit losses will be evaluated and estimated, entities should examine several factors, including the following.

Inputs (Expected Credit Loss Drivers and Expected Life)

For financial assets measured at amortized cost, a current estimate of all contractual cash flows not expected to be collected should be recorded as an allowance for expected credit losses. Entities should consider “past events, current conditions, and reasonable and supportable forecasts when developing their estimate of contractual cash flows over the life of a related financial asset.” Entities should also consider “relevant quantitative and qualitative factors” that exist in their business environment and similar factors that relate to their borrowers (underwriting standards, for example).

Entities will need to determine estimates of the expected life of a financial asset by considering expected prepayments but not considering expected extensions, renewals, or modifications – unless the entities anticipate executing a troubled debt restructuring with the borrower.

Crowe observations:

- The shift from the incurred loss model – which required a loss to be “probable” before it was recognized – to the CECL model – which represents all contractual cash flows not expected to be collected – will be a significant change that will require alterations to an entity’s allowance methodologies and data needs.

- The quantitative and qualitative factors already noted could be from either internally or externally available sources.

- With the change to an expected loss model, the consideration of prepayments for the expected life of longer-term financial assets, such as 30-year mortgages, can be important depending on how the allowance methodology functions.

- Consideration of some of the OTTI criteria for HTM securities will no longer be required. However, the evaluations of expected credit losses for some debt securities, such as residential mortgage-backed securities (RMBS), are likely to be similar to those previously used in practice – with the exception of the potential for required pooling of HTM debt securities. In current practice, entities evaluating OTTI often have modeled both HTM and AFS RMBS debt securities based on available internal and external statistics for similar instruments.

- Historically, existing U.S. generally accepted accounting principles (GAAP) and regulatory guidance have not addressed payment turnover for lines of credit and credit card loans (that is, if the average life is determined based on gross payments or net payments). It remains to be seen how the standard will address the expected life of a financial asset such as a credit card receivable.

- The FASB concluded in its re-deliberations that loan commitments will be addressed in the CECL model, with the funded portion being similar to existing loans. If unfunded commitments cannot be unconditionally canceled by the lender, expected credit losses will reflect the full contractual period.

Unit of Account

In its re-deliberations, the FASB concluded that entities will be required to evaluate expected credit losses on financial assets on a pool basis if the assets share similar risk characteristics and are measured at amortized cost. At times, an institution might not have multiple assets with similar risk characteristics; in that case, it would then evaluate those financial assets on an individual basis. The evaluation of individual financial assets under the CECL model “should consider relevant internal information and should not ignore relevant external information” (for example, credit ratings and credit loss information for financial assets of similar credit quality).

Crowe Observations:

- For financial assets evaluated on an individual basis, the removal of the “best estimate” notion and the inclusion of relevant internal and external information are likely to encourage institutions to consider, based on expectations of losses for pools of similar assets that might be externally available, the possibility of expected losses on that individual asset. Said another way, where a previous conclusion might have resulted in the best estimate of a zero loss on an individually evaluated loan, a different answer might result when considering the available external information indicating that a probability of a loss exists.

- The requirement to measure impairment under CECL first by pooling financial assets with similar risk characteristics would apply to all financial assets that are in scope – generally, financial assets measured at amortized cost. Accordingly, HTM securities that are measured at amortized cost will be in scope and be required to be measured for impairment in a pool with securities that share similar risk characteristics – which would be a change in practice from today.

Probability or Path

In its re-deliberations, the FASB concluded that entities “should always reflect the risk of loss, even when that risk of loss is remote.” However, entities would not be required to recognize a loss in the event that there is a probability of default but the amount of the loss severity would be zero (that is, there is adequate collateral in the event of default). In other words, if the amount of collateral is such that no loss would be recognized in the event of default, a loss need not be recognized.

Entities will need to develop an estimate of the expected credit losses, and one method might include starting with the historical losses and then adjusting for differences based on current conditions and reasonable and supportable forecasts. However, the FASB clarified that entities will not be required to forecast conditions and make related adjustments to the historical loss patterns for the expected life of the financial asset; instead “an entity should revert to unadjusted historical credit loss experience for future periods beyond which the entity is able to make or obtain reasonable and supportable forecasts.” Commonly, this is referred to as reversion to the mean. Reversion to the mean or mean reversion is a mathematical theory often used in various financial applications such as stock investing. In simple terms, a variable is “mean reverting” if it tends to decline in the next period if it is currently above its long-term average or tends to increase in the next period if it is currently below its long-term average.

The FASB provided two alternatives to accomplish reversion to the mean: (1) by reverting over the financial asset’s estimated life on a straight-line basis or (2) by reverting over a period and in a pattern that reflects the entity’s assumptions about expected credit losses over that period. As an example, assume that an entity has a 30-year residential mortgage with an estimated life of seven years. Management can reasonably estimate expected credit losses for the next two years, but after that, management does not have reasonable and supportable forecasts to determine expected credit losses. One option to establish expected credit losses in the final five years would be to revert on a straight-line basis to the unadjusted average credit losses for the remaining period. For example, if expected losses over the next two years are 10 basis points (bps) and the unadjusted historical loss experience is 15 bps, the straight-line reversion would be as follows:

Crowe Observations:

- The FASB’s characterization of “risk of loss” establishes a high hurdle for recording no expected credit loss. Institutions will be required to consider the likelihood of nonpayment or a loss based on all available information, but information indicating a probability of default may be offset by the impact of collateral and other available sources of repayment.

- Entities will make projections about the expected losses as far as they can reasonably estimate into the future. The FASB has provided a practical expedient by allowing entities to assume that over the remaining term of the financial asset expected credit losses should return to their unadjusted average historical credit losses. Entities will have an option to select either pattern of reversion which would be disclosed. Changes in the reversion period would be a change in estimate rather than a change in accounting policy (a change in accounting policy would require the change to be preferable).

Examine Methodologies Commonly Used Today

Providing flexibility, the FASB concluded that there will not be restrictions on the types of methodologies used to develop an estimate of expected credit losses. Specifically, it said that entities will not be prohibited from using discounted cash flow, loss-rate, probability-of-default, or provision matrix models when developing their estimates. Many models currently used by financial institutions would fit into one of these categories.

At times, different models are used on different asset types, or combined to use on one asset type, to develop an estimate of credit losses. Examples of some models used in practice today include:

- Discounted cash flow analysis

- Average charge-off method

- Vintage analysis

- Static pool analysis

- Roll-rate method (migration analysis)

- Probability-of-default method

- Regression analysis

Following is some background on how each of these examples is used today in the incurred-loss model for the allowance for loan losses.

Discounted Cash Flow Analysis

As described in ASC 310-10-35, a discounted cash flow analysis is based on the present value of expected future cash flows discounted at the loan’s effective interest rate. This type of analysis is one of the current prescribed methods for measuring impairment on an individual impaired loan. (Alternatives include the practical expedient of applying the collateral-dependent method or the observable market price approach.) Expected cash flow assumptions used in the discounted cash flow analysis are based on an institution’s best estimate of “reasonable and supportable assumptions and projections.”

Crowe Observation:

- While the collateral-dependent method is not covered in the scope of this article, the definition of “collateral-dependent” is slated to change slightly, which will alter when it is appropriate to apply the collateral-dependent method.

Average Charge-Off Method

The average charge-off method is generally the most commonly used approach for evaluating impairment on pools of financial assets and is fairly straightforward relative to many other approaches. This method calculates an estimate of losses primarily based on past experience. Generally, an institution starts by dividing the financial asset portfolio into segments and then determines a historical look-back period (which, depending on the asset class, could be a number of months or a number of years) that is long enough to develop an accurate estimate of incurred losses for the segment. Next, the institution calculates an average charge-off ratio for each segment and makes necessary adjustments to that historical average charge-off ratio to reflect the impact of differences in various quantitative or qualitative factors. In addition, institutions often “weight” the data in the look-back periods in an effort to develop an appropriate estimate of probable incurred losses that exist at the point of measurement.

Depending on the portfolio, segmentation can be achieved in many ways by identifying similar risk characteristics (for example, financial asset type, collateral type, size, credit score, geography), and the data needs of this method are modest compared to those of other methods.

Vintage Analysis

Vintage analysis measures impairment based on the age of the accounts and the historical asset performance of assets with similar risk characteristics. This methodology works well with types of financial assets that follow patterns or curves of losses that are comparable and predictive for subsequent generations of financial assets (indirect auto loans, for example). First, an entity determines an appropriate type of financial assets that share similar risk characteristics, and then the entity develops a cumulative loss curve for the applicable financial assets based on historical data. It is common for different “vintages” to be analyzed by year of origination assuming the pool of loans is homogenous.

For vintage analysis, adjustments may be made for differences in quantitative or qualitative factors from period to period, but generally the financial asset would be assigned a loss factor based on the point on the loss curve that correlates to the financial asset’s age.

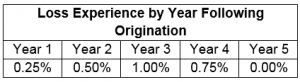

For example, a pool of similar five-year financial assets might show loss experience as follows:

Typically, the incurred losses for a pool of assets in year three would be 1 percent. However, based on the historical loss experience shown in the table, the total expected losses for the life of the pool of assets would be 2.5 percent, which is the accumulation of the five-year loss experience.

Static Pool Analysis

Static pools generally are formulated by aligning common risk characteristics within existing segments or classes of loans. Static pools often are segmented by similar risk characteristics such as collateral type, loan structure, credit risk indicators such as risk rating or consumer credit scores, and loan to value for assets originated in the same period. Commonly used to track loss rates, static pools also can be used to track other assumptions affecting credit loss and timing – assumptions about prepayment rates, cumulative default probabilities and default curves, and loss severity, for example. Thus, static pools often are used to support many components of the various acceptable methodologies.

Vintage analysis and static pool analysis are commonly interchangeable terms; however, “static pool” simply means segmenting and tracking assets over a period of time based on similar risk characteristics. In practice, the main difference between vintage and static pool analysis is that vintage analysis is based on the year of origination or the age of the asset while static pool analysis is based on a type of shared pooling criterion and assets originated in a similar time period.

Roll-Rate Method (Migration Analysis)

The roll-rate method is often referred to as “migration analysis” or “flow model” and is based on determining a prediction of credit losses based on segmentation (by delinquency or risk rating, for example) of a portfolio of financial assets. No standard roll-rate model is used throughout the financial institutions industry, but most of the models used are based on similar underlying principles.

For example, the portfolio could be divided into different risk ratings. Once segmented, the percentages of assets that will “roll” or “migrate” to a more severe risk rating are measured and are referred to as “roll rates.” Financial institutions might incorporate an averaging technique over time in order to develop an average roll rate for each segment that could be adjusted for quantitative or qualitative factors. After the roll rate is determined for each segment, each respective roll-rate percentage is applied to the balance in each category to arrive at an estimate of the amount that will migrate to the next category. The total migration for each category is aggregated to determine the allowance.

Probability-of-Default Method

The probability-of-default method is used to estimate credit losses by using three components: (1) probability of default, (2) exposure at default, and (3) loss given default. Uniform definitions of “default” and “loss” are used. The method is also used by many risk management systems and within the Basel II and Basel III frameworks.

The three components generally are defined as follows:

- Probability of default (PD) – Probability of default over a given time period

- Exposure at default (EAD) – Balance of the relationship at default

- Loss given default (LGD) – Ratio of loss relative to the EAD at default

In this simple illustration, assuming none of the three components is correlated with any other component, expected credit losses would be expressed by the following equation:

Credit losses = PD × EAD × LGD

A financial institution will segment its portfolio by risk characteristics and develop estimates of these three components. The development of each is generally completed as follows:

- PD could be a simple average, externally acquired and mapped to the specific segments analyzed, or it could be based on various default probability models on a by-borrower or by-dollar basis.

- EAD could be the balance of the financial asset today or a higher or lower balance depending on the type of product (amortizing, nonamortizing, or revolving).

- LGD – similarly to PD – could be a simple average, externally acquired, or based on models.

After the portfolio is segmented and these factors are developed, further adjustments can be made in consideration of correlations that might exist among the factors. While beyond the scope of this paper, one consideration for a probability-of-default model is the impact of correlation between the components. As an example, during a recession, it is common for probability-of-default to rise and loss-give-default also to rise. An entity should consider appropriate adjustments for the correlation of these components to not misstate the amount of credit loss.

Regression Analysis

Regression analysis uses economic data such as unemployment rates, bankruptcy rates, and the consumer debt-to-income ratio to estimate a relationship between this data and losses in a portfolio. Essentially, an institution uses statistics to determine an estimate of credit losses (the dependent variable) based on one or multiple inputs (independent variables). Because of the complexity of the models, the data requirements, and the need for highly trained personnel, regression analysis is not widely used in practice, but it is used at times in combination with some of the other methodologies.

Some Considerations for How Current Methodologies Will Change Under the CECL Model

Regardless of how allowance amounts are calculated, generally the CECL model will incorporate one significant change based on the previously discussed methodologies. Specifically, the CECL model will require a change to the allowance methodology from today’s incurred loss model to an expected credit loss model, which is a lifetime estimate. That fundamental change will cause institutions to have to develop estimates that are clearly more forward-looking than they were in the past.

Institutions will have to change their methodology (either modify their existing methodology or make a wholesale change in methodology) to implement the CECL model. While institutions may use existing risk management practices or systems to develop this forward-looking estimate, many of those systems may not have been subjected to financial statement and internal control audits, and entities should consider this as they develop a plan to implement the CECL model.

Fundamentally, entities will see changes in the data needed to implement the CECL model. For example, entities might need to develop and construct loan pools to analyze historical performance. These loan pools likely will need to include longer look-back periods and new data to enable the analysis of new factors such as prepayments. Changes in the methodologies implemented or the risk characteristics used to organize the portfolio also could require new data to be historically gathered as well as prospectively tracked (an example could be credit scores or other underwriting criteria).

Discounted Cash Flow Analysis

Discounted cash flow methods are expected to change under the CECL model due to the removal of the “best estimate” notion and a requirement to consider at least some risk of loss. Accordingly, new data might have to be developed or obtained to support the cash flow expectations, especially for individual assets given that analysis must now incorporate relevant external factors that may indicate an expected credit loss.

Average Charge-Off Method

Historically, average charge-off methods have incorporated a look-back period during which an average charge-off percentage is developed. One consideration when applying the CECL model will be changing from what frequently was an annual average charge-off rate to a lifetime charge-off rate. The FASB’s 2012 exposure draft did not allow simple multiplication of the average annualized charge-off factor for the expected life of the asset to develop an expected loss, so a different analysis might be required. Options for deriving the expected credit losses might include static pool analysis or the application of dynamic annual charge-off rates in conjunction with dynamic annualized prepayment expectations applied to a pool of financial assets for the remainder of their life. Dynamic assumptions are typically used today in modeling RMBS OTTI and are generally supported by current pool performance and historical vintage analysis.

One additional consideration for average charge-off methods is that the base percentage is grounded in historical data, but average charge-off methods frequently require that subjective adjustments be made to reflect changes. Typically, these adjustments consist of one aggregated adjustment supported by several factors, which can be difficult to quantify and support. Our expectation is that qualitative adjustments to average charge-off models will continue under the CECL model. Some of the other methodologies (such as probability-of-default methods) handle individual subjective adjustments that can be supported at the factor level (such as prepayment speeds or collateral value changes) and derive changes in estimates accordingly.

Vintage Analysis

Vintage analysis is based on loss curves that include expectations of losses at each point in the life of a financial asset. Accordingly, the main change to this method under the CECL model is that the allowance will no longer be reflected by a point on the loss curve; rather, it will be reflected by the remaining area under the loss curve (that is, the expected credit losses on the remaining life of the asset).

Static Pool (Cohort) Concept

It is important to understand that whatever methodology is used to forecast expected losses, there will be a need to establish a baseline expectation of portfolio performance based on history. Institutions likely will resort to use of a static pool concept, also referred to as cohorts. Static pools generally are formulated by aligning common risk characteristics within existing segments or classes of loans.

Establishing static pools based on origination dates (same month, quarter, or year) will allow an institution to track life-to-date loss rates and other performance characteristics that, as tracked over the life of the loans, will generate a baseline for a lifetime of loss estimate. Institutions will need to assess their ability to perform this type of analysis looking back over several years of origination and collection data for the initial implementation of the CECL model.

Roll-Rate Method (Migration Analysis)

With the roll-rate method, a financial institution will need to assess the primary attributes that most appropriately predict loss and take into account significant historical data sets. For example, some institutions might believe that implementing a CECL roll-rate method based on risk rating will be the most predictive of expected losses. However, analysis of various data sets is needed before the final assessment can be made about what might be most predictive. Often roll-rate models based on risk ratings are not the best predictive measure because they require regular and timely updates to credit risk ratings for all assets.

Default or loss migrations should be assembled to reflect various economic cycles and tested through those cycles to assess reliability of the model. Limitations on time series length, data integrity, and population sizes may need to be supplemented with judgments and further calibrated over time to improve precision. Ultimately, it will take time for an institution to make these final determinations before deciding to implement such a methodology.

Probability-of-Default Method

In order to develop a model driven by the probability-of-default method, the institution must consider significant attributes that underlie the various pools of assets and demonstrate the strong predictive power of the model through continual back-testing. Institutions applying a probability-of-default method for the first time will need to assess the reliability and accessibility of historical data sets that may be used to build the cumulative default probabilities and loss given default.

The institution will first need to assess a standard definition of default and paths to default that might occur within a product line. Various industry sources of data can be used to assess probabilities of default over various economic cycles to supplement the institution’s own experience. The performance of commercial mortgage-backed securities and residential mortgage-backed securities, reflecting defaults, prepayment activity, and severity assumptions, for example, can be obtained from various ratings agencies and servicer reports. However, an institution using industry data must demonstrate comparability among the portfolios being measured. Whether default probabilities are driven by risk rating, past-due status, consumer credit scores, loan-to-value ratio, or something else, before the model is implemented it will need to be tested over a significant period of time to prove its predictive power.

Regression Analysis

Regression analysis might be a strong statistical tool to quantify or assess the predictive power of a particular set of assumptions. In particular, this type of analysis can be useful for developing support for quantitative associations between macroeconomic factors and losses. For example, one could use regression analysis on economic data such as unemployment and bankruptcy rates to forecast loss rates on consumer loan products. Using collateral pricing curves, one might use regression analysis on actual loss-severity data to assess the predictive power of a particular assumption (such as the impact of changes in home price indexes to change in loss given default).

Institutions must assess the confidence level or imprecision acceptable with the use of statistical models. They should understand and assess imprecision in the models relative to the materiality impact of the allowance calculation and continually calibrate the models for actual performance. Given the specialized skills needed to interpret and test the results driven by statistical analyses, institutions might need to purchase additional quantitative tools or acquire new talent to implement these more complex methodologies.

Conclusion

There are several methods available to financial institutions to comply with the CECL model. While the final standard is not yet issued and the effective date has yet to be set, it’s not too early for financial institutions to think about the methodologies available and how their existing allowance methodologies would convert to lifetime expected credit losses under the CECL model. Financial institutions will certainly need time to develop their sources of data, whether internal or external, and to subject their planned approach to adequate testing so that it will be robust enough to use well into the future – and the FASB will take that into account when determining the effective date.

Originally published in December 2014 by Crowe Horwath LLP. Used with permission.