The Financial Accounting Standard Board’s Current Expected Credit Loss Model, or CECL, represents a major change to how financial institutions and other entities measure credit losses, and for many banks and credit unions, the transition can seem daunting.

The extra time that the FASB plans to give many financial institutions in an updated CECL implementation timeline might tempt some management teams to “stick their heads in the sand” and instead, focus attention on more pressing deadlines. However, FASB members and audit industry experts have urged bankers to use the time wisely. They have suggested obtaining better data, building more robust internal controls, learning from results of large SEC filers (who begin implementation in 2020), and perhaps approaching CECL implementation as a business solution.

An important step in CECL implementation is selecting what methodology or methodologies the institution will use for estimating credit losses. The good news is that the FASB has emphasized that the accounting standard is not prescriptive about which methods are relevant and appropriate for estimating credit losses: “The Board has permitted entities to estimate expected credit losses using various methods because the Board believes entities manage credit risk differently and should have flexibility to best report their expectations.” – ASU 2016-13 (Topic 326) Paragraph 326-20-30-3.

However, that same flexibility in methodology selection can hamstring a financial institution if staff find it difficult to narrow down their options. Some financial institutions have described how they made key decisions on loan segmentation and methodologies, and those examples can be useful.

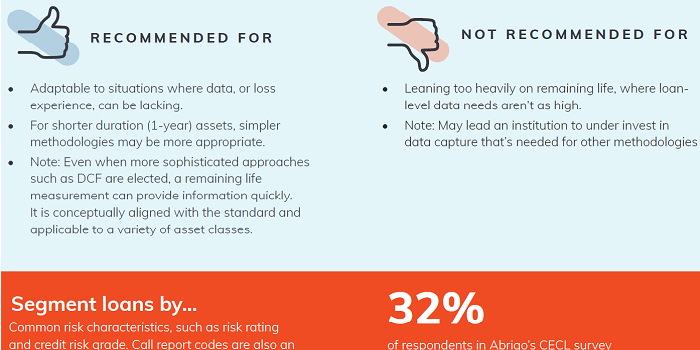

For a quick glance at the seven methodologies available, and to get a better sense of how they compare, you can also check out this complimentary infographic, “CECL Methodologies: Pros and Cons for Your Loan Pools.” It provides a brief definition of each methodology and examples of when each methodology is generally recommended or when it might not be appropriate. In addition, it reflects on Abrigo’s 2019 CECL Survey to show how many of your peers are considering that specific method.

The methodologies covered in the infographic include:

- Static pool analysis

- Discounted cash flow

- Migration analysis

- Transition matrix

- Vintage analysis

- WARM/Remaining life

- Probability of default/Loss given default

Download the infographic here.