The piano can capture a variety of moods, depending on the musician at its seat. But even simple melodies from a finely tuned piano can tell a story. And when a few instruments combine, following the same sheet music – the correct key and time signature – the story’s effect is even stronger.

The same can be said for banking risk management. Distinct risk management processes can be both effective for satisfying compliance requirements and helpful for strategic decision making. For example, loan-portfolio stress tests give institution leaders a pulse on credit risk today and potential risks in the future. Likewise, liquidity shock tests provide clarity and guides decisions around raising capital, concentration limits, and excess capital. And for each department head, like a Chief Credit Officer or Chief Financial Officer, information accessibility makes risk measurement and mitigation straightforward.

If the institution’s management wants a comprehensive view of risk, however, information accessibility and model incongruency become weaknesses. Data is stored in spreadsheets, or slightly better, monthly dashboards borne from different departments.

To align these and other risk management processes, they need to use the same sheet music, so to speak.

ERM Today

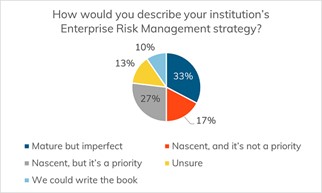

During a recent Abrigo webinar, financial institution leaders were asked to gauge the maturity and priority of their enterprise risk management (ERM) framework. The results showed that for most respondents’ institutions, ERM is a priority but often a work in progress.

Thirty-three percent of attendees indicated their program is “mature” but still has room for improvement. Meanwhile, 27% indicated their ERM program is in its early phases.

Only 10% of respondents felt that their ERM program needed no improvement.

Aligning Financial Risk Modeling

In the absence of a formal ERM program, an area in which bank and credit union leaders can focus is financial risk modeling. By starting with this reduced scope, the bank benefits from a shorter list of key players and interrelated data that allow for alignment.

In the same webinar, Navigating Post Pandemic: A Stronger Enterprise Risk Program, Dave Koch, the Managing Director of Advisory Services from Abrigo, recommended ways in which bank leaders can coalesce financial risks. He suggested reviewing common scenarios used between risk silos. What assumptions are used for moderate or severe credit stress tests or as part of the Allowance for Loan and Lease Loss funding? If those same scenarios were applied in modeling earnings and liquidity, how would the bank fare? In using the same scenarios, bank management can identify potential interactions and overall impact on bank capital and performance, and some examiners or auditors will look for consistency across all financial results.

Similarly, Koch recommended looking at the data sources used across risk analyses. Is it coming from the same, reliable source, and is it used with equal granularity?

“If we are using combined balances in an aggregated assessment over here, but we’re doing loan-level data over there, you’re going to have a mismatch,” suggested Koch, much like if orchestra members use a different time signature.

It can be far easier to align assumptions and key data sets, Koch explained, when the institution is using a single platform for financial risk modeling. Bankers can avoid “Frankenstein” dashboards with reports from different systems, and documentation is consistent for audit and exam time.

Why It Matters: Post-Pandemic Economy

Unifying risk reporting is especially relevant now, as we move into a post-pandemic environment.

“As we try to ask the question, ’How do we make more money going forward coming out of this pandemic,’ the only answer is that we have to take on more risk. So, what kind of risk are we going to take, and can I afford to take it,” Koch explained. “By having a green, yellow, or red type indicator, you’ll see where there’s room or where you might be willing to go into yellow because it provides the best risk versus return tradeoff.”