Bankers’ ALLL feedback, summarized

Apr 14, 2015

This feedback is made possible by ALLL.com visitors voting in polls. We’d like to thank those who participated and encourage others to submit their feedback in the site’s polls, as well as within the Peer Discussions forum. Based on an average sample size of 53 respondents per poll, we are now able to share the statistically significant results.

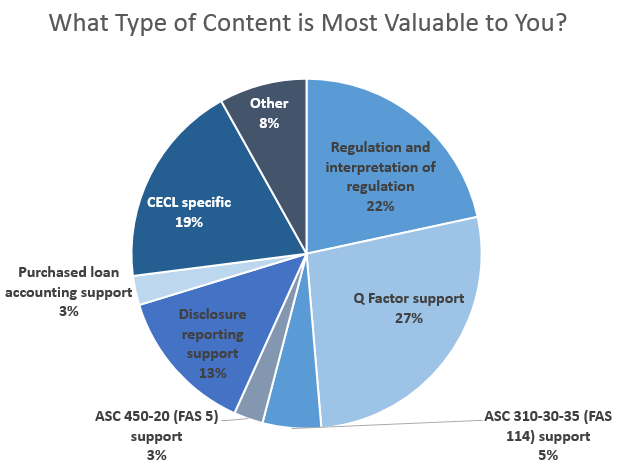

First, we asked visitors what type of content they value the most. Not surprisingly, Q factors ranked atop the list. Often a source of confusion for institutions, this component of the ALLL tends to be the most subjective and, consequently, the most scrutinized by regulators. “Regulation and interpretation of regulation” (22 percent) was a close second in the poll. Institutions have faced an increasingly burdensome regulatory environment of late; in fact, the third quarter of 2014 marked the highest level of regulatory changes since 1995, according to the Banking Compliance Index (BCI). With 82 changes implemented in the quarter alone, it should come as no surprise that institutions value resources to mitigate the demands posed by regulation. More specifically, and falling within the regulatory scope, 19 percent of respondents indicated they value resources specific to the FASB’s CECL model.

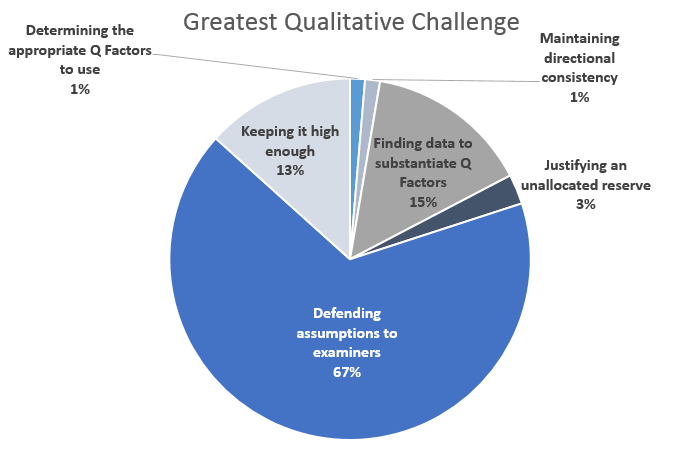

Delving into the topic most valued by bankers, we asked which obstacles challenge institutions the most when calculating, documenting and defending qualitative factors. While guidance provides direction on this topic in the form of Nine Standard Qualitative Factors for the ALLL, institutions face the challenge of gathering the data to substantiate these adjustments (15 percent) and defending their assumptions to examiners (67 percent). While this source of subjectivity may present a challenge to institutions, certain measures, such as creating a qualitative scoring matrix, backtesting and using internal and external drivers, will add objectivity to this task and create a thorough, defensible qualitative analysis.

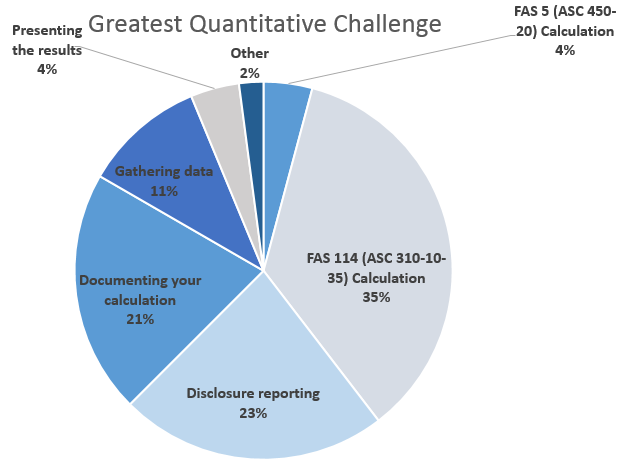

Aside from the complexities that arise in generating a defensible qualitative and environmental analysis, there are other challenges in the ALLL calculation with respect to quantitative analysis. While we were able to conclude that any and all components of the quantitative analysis can pose the greatest challenge to institutions, certain portions of the calculation were more commonly identified as being the most challenging. The FAS 114 (ASC 310-10-35) calculation poses the greatest challenge to many institutions (35 percent), followed by disclosure reporting (23 percent) and documentation (21 percent). With regard to these challenges, institutions should know How to Calculate FAS 114 Reserves, 6 Key Items About Disclosure Reports and What Examiners Expect in Documenting the ALLL.

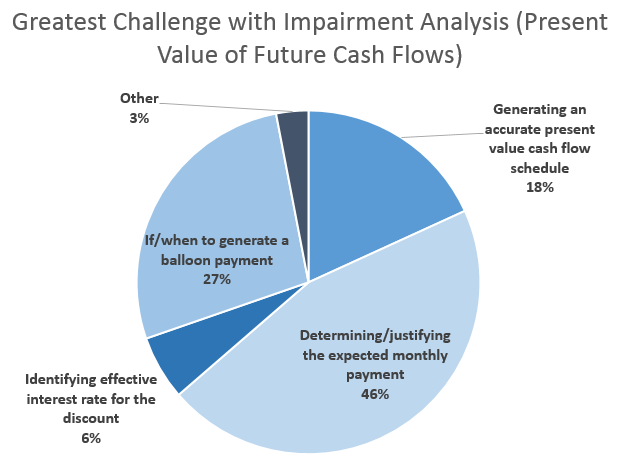

Within the FAS 114 (ASC 310-10-35) component of the ALLL – that which represents the greatest quantitative challenge – there are three valuation methods to assess impaired loans. For loans evaluated under the Present Value of Future Cash Flows, institutions must generate a cash flow schedule of repayment to determine the reserve amount. Certain challenges arise within the application of this methodology, and as determined by our poll participants, the most common challenge institutions face is determining and justifying the expected monthly payment.

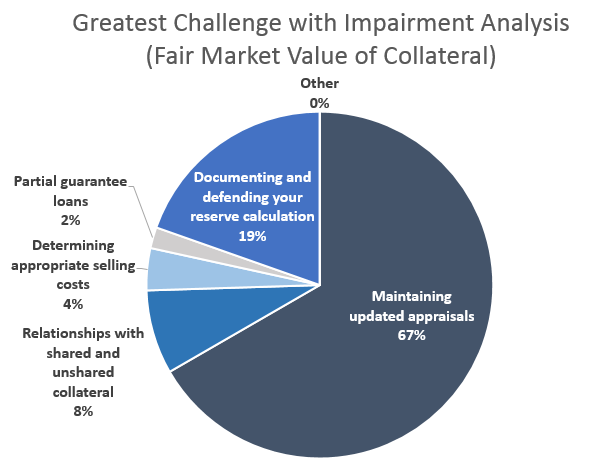

One of the two remaining impairment analysis methods is Fair Market Value of Collateral. In this methodology, institutions measure the fair market value of collateral against their loan to determine the reserve amount. Certainly collateral documentation is crucial for defending your analysis, as is reflected by 19 percent of poll respondents. Related to proper documentation is maintaining updated appraisals, representing the largest challenge for a rather conclusive 67 percent of respondents. Guidance recommends appraisals be updated on an annual basis; however, if this is not feasible for institutions, an accepted – albeit more scrutinized – alternative is to implement discounting and other measures to assess a fair value when a recent appraisal is not available.

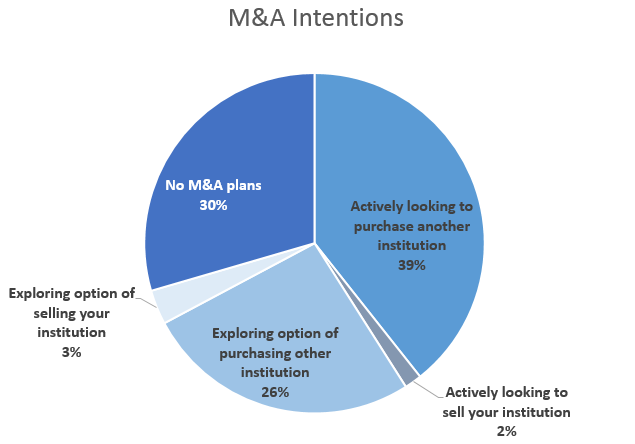

We asked institutions about their intentions as they relate to mergers and acquisitions. As continued economic improvement couples with an increasingly complex regulatory landscape, we find a market primed for consolidation, which is reflected in the below poll. While only 5 percent are siding toward selling their institution, we see a strong 65 percent with eyes on acquiring. We may well see this number increase once FASB’s CECL model is released, as some banks may struggle to overcome the increased complexities and strain on capital due to the one-time adjustment. Those that are actively pursuing an acquisition should be familiar with the regulation and accounting requirements for purchased loans.

The allowance for loan and lease losses is undoubtedly one of the most complex calculations an institution makes each quarter. It requires excellent data management, concise organization, complex estimations, input and assumptions from management and scrupulous attention to detail in supporting documentation. We hope you find the associated resources helpful in your ALLL calculation, and we hope you find comfort in the feedback of your peers showing that you are not going this course alone! We encourage your comments to contact@ALLL.com, continued feedback in the form of polls, and if ever you face a difficult question regarding the allowance calculation, use the Peer Discussions forum to gather feedback from your peers and advice from industry professionals.